Residential Mortgages

Looking to buy a property in the UK?

JIB is ideally suited to be your partner in this important decision. Whatever your dream home, be it a house, an apartment or somewhere for your son or daughter to stay while at university, as long as the minimum loan is over £150,000, we are in a position to assist. We offer mortgage finance up to 70% of the property value with repayment periods of up to 20 years.

Your Questions Answered

01

What do I need to apply

If you are already banking with JIB, please contact your Private Banking Manager. If you are not currently a client of JIB, please contact us on 020 3144 0200

02

What is the process

To start on the path to buying your UK property we will need to understand your requirements, your repayment proposals, and various personal details. This enables our Private Banking Relationship Managers, all of which are qualified Mortgage Advisors, to follow the code of business for mortgages as laid down by the Financial Conduct Authority.

03

Do I need to have identified a property

No, we can provide an indication of what mortgage terms we could offer including a decision in principle which enables you to negotiate favorably with any seller.

04

How long does it take

If you have already identified a property and can provide the necessary documents in a timely fashion, the mortgage process normally takes between 1 and 3 months.

05

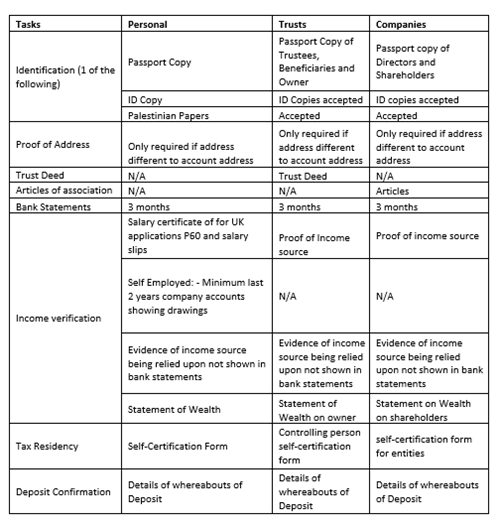

What documents might I need

06

Why choose Jordan International Bank

JIB is focused on serving international clients, especially from the Middle East with Arabic-speaking relationship managers and over 30 years of experience in the UK property market. Mortgage advice that relates to a property in the UK which is the primary residence (i.e., not a commercial or buy-to-let property) is protected by the Financial Services Compensation Scheme (FSCS). Compensation is up to £85,000 per eligible person. . JIB is a member of UK Finance mortgages.

07

Whose names can I have the mortgage in

You can buy the property in your sole name, jointly with up to 3 other people; or alternatively in a trust or in a Special Purpose Vehicle.

08

Do I need to be a client of Jordan International Bank

To enquire about mortgages with JIB you do not need to be a client, however, to take up any mortgage offer provided by the bank you would need to open a current account under our standard terms to service the mortgage and ancillary expenses.

09

How is the Banks mortgage rate calculated

JIBs' reference interest rate is currently 5%. This rate will generally mirror changes in the Bank of England base rate but is at the discretion of the bank.